[ad_1]

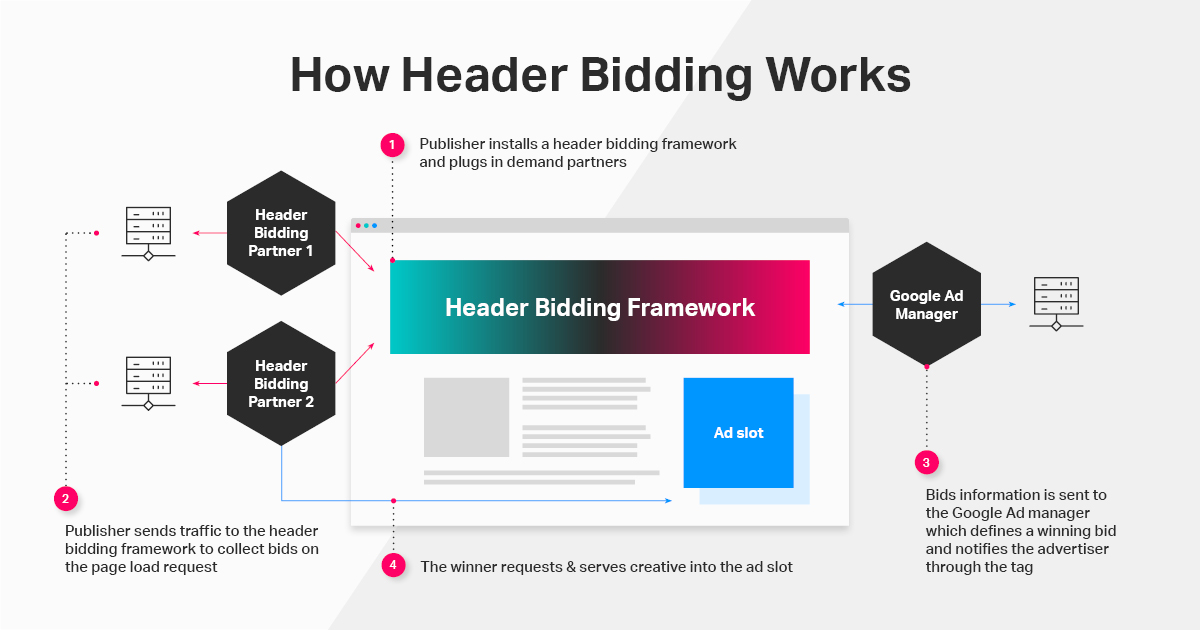

Header bidding technology allows offering ad spaces simultaneously to multiple DSPs and ad exchanges before making requests to the ad server. It helps decrease page load time and creates a transparent partnership between media companies and advertisers.

The popularity of this technology has grown over the past few years. According to Statista, as of Q1 2022, 70% of US publishers adopt header bidding technology on their sites.

Header Bidding Trends 2024: The Updates You Need to Know

Header bidding solutions are expanding following the growing market demand. Therefore, technology is becoming more sophisticated over time. AdTech companies determine new ways of growth, providing programmatic parties with more advanced tools and mechanisms. In this article, we look through the most demanded header bidding trends over the past year, as well as predictions and forecasts for why they will continue.

1. Video header bidding

Video header bidding has two major advantages for publishers. First, it decreases the latency of video content loading as an auction initiates before the video starts playing. Second, video header bidding brings maximum yield to publishers. The technology allows advertisers to bid simultaneously as opposed to the waterfall model in which DSPs call the bid one by one until one of them offers the price which is higher than the floor rate. Parallel auction in contrast to waterfall brings the highest bid proposed among all participants at once.

It’s predicted that $168 billion of all US digital display ad dollars will be transacted programmatically in 2024. And the video formats take more than half of the amount. As for devices, in the Video Advertising market, US$193.4 billion of total ad spending will be generated through mobile in 2028. According to the IAB’s Revenue Report, 2023 programmatic advertising revenue grew to $114.2 billion, with an increase of 4.4% or $4.8 billion compared to 2022. Video ad formats will be in great demand in the following years. So, applying header bidding for video inventory can bring publishers more programmatic yield.

2. Header bidding wrappers

Header bidding wrapper is a technology that was initially developed as a solution on how to organize a large number of buyers. Publishers who work with many advertisers and different header bidding solutions prefer wrappers. The core principle of the header bidding container, as it is also called, is to ensure that all bids are triggered in parallel. It forms the rules for a programmatic auction to bring the highest bid. And in such a way, publishers have more control over their programmatic yield.

Particular SSPs and open-source Prebid frameworks, for instance, develop proprietary wrappers. Many wrappers have been widely adopted by publishers. However, most are based on the flexible Prebid framework, which can be customized to meet publishers’ requirements. Builtwith counts 22,450 websites that are using Prebid globally as of March 2024. Currently, 28% of the top 1 million sites by traffic are using the Prebid wrapper. Only Amazon Transparent Ad Marketplace ranks higher. It is used by 46% of 1 million sites by traffic.

3. Server-side header bidding

Initially, header bidding was carried out on the client side (browser side). A JavaScript code added to a site’s header makes the technology work. It connects all sources of buyers who bid for ad inventory. The downside is that the browser allows connecting to a limited number of sources. Moreover, a large number of advertisers connected to a header bidding wrapper leads to a lower page speed because of running a lot of JavaScript processes on the page.

Speed and page load time continue to be highly important for publishers. And server-side header bidding is much more efficient at this point. The whole process of header bidding auctions is conducted on an external server of the ad tech company. The publisher needs to add a snippet of code on the site, but requests are sent from the ad tech server to all relevant DSPs, not from the browser. Technology is easy to integrate. It allows more demand partners to add to the auction and shrinks page load time.

4. Artificial intelligence and machine learning

AI and ML technologies have significantly impacted the global economy for the last few years, and the advertising industry is no exception. AI marketing revenue worldwide has been growing since 2020 and is predicted to grow by 600% in 8 years. In the advertising industry, among other things, AI provides the necessary predictive analytics, ensuring relevant and effective advertising campaigns with advanced targeting. With AI bidding strategies, bidding strategies can be automated and optimized in real-time, quickly adapting to changes in the market and user behavior.

AI and its analytical tools are integrated into predictive analytics of header bidding. These algorithms analyze bid data, user engagement, and other important parameters, resulting in a significant increase in the efficiency of advertising inventory distribution for the publisher and the effectiveness of the campaign for the advertiser.

5. Mobile in-app header bidding

Considering the increasing number of mobile apps and in-app mobile ad spending, programmatic buying methods have become a hot topic for the industry. In-app bidding is becoming one of the trendiest technologies for app publishers, though it is at an early stage of development. The AppLovin (former MoPub) advanced bidding tests showed real advantages of in-app bidding, such as an increase of 5% to 15% in publishers’ ARPDAU, an increase in filled supply, an increase in supply access for all programmatic buyers, and an enlarged wallet share for all programmatic partners.

Even though some big tech providers have started to launch in-app solutions, it is still a challenge for most app publishers. The main complication for adopting in-app header bidding has remained a lack of good bits of knowledge on how it works and on the implementation issues, both from publishers’ and advertisers’ sides. So still more lightweight solutions are necessary for the market. Publishers used to appeal to SDK mediation solutions based on the waterfalling method but the quantity of partners is limited and more manual work might be required. The in-app bidding, in contrast to, helps to reduce the necessity of SDK implementation since the solution provides access to a big number of demand partners. Technology is seen as beneficial for publishers, buyers, and mediation platforms alike. But time is needed to make it work for the majority.

6. In-house and customization

IAB Europe reports that 66% of publishers are considering bringing programmatic trading in-house in the next 12 months. The rate has increased from 34% since 2016. This could be explained by the fact that the demand keeps growing, and publishers want to optimize their programmatic ad selling as efficiently as possible and take control of the process. Programmatic in-house brings many benefits, such as ad performance improvement, transparency, and programmatic yield boosting. By implementing an in-house header bidding infrastructure, publishers can make more informed decisions through every step of the process to gain maximum revenue.

Although it can be challenging because of a lack of practical knowledge on operating it, building an internal header beading framework means better monetization for publisher inventory and more operations control. “A third of publishers (35%) are developing in-house operations to gain greater transparency and control of their programmatic processes, ” per the IAB Europe presentation. To start with, by combining in-house operations and external support from ad tech partners, publishers can do their best for themselves.

7. OTT and header bidding

The rise of OTT platforms has changed the way content is consumed and provided new opportunities for programmatic advertising in the area where traditional TV advertising used to be. Viewers are switching to OTT platforms, and the advertisers follow them. With OTT, marketers can target the audience and provide personalized advertising. The implementation of header bidding in OTT gives unique opportunities, and although technically, it is quite a challenge to obtain seamless integration of advertising into content streams with HB in OTT, the vast potential and benefits are pushing development and investment in this area.

8. Privacy and personal data regulation

Introducing new privacy regulations and requirements in the US and EU have profoundly impacted the advertising landscape. These rules have redefined how personal information is handled, pushing the advertising market for better privacy protection and better user control over their data.

With header bidding, publishers offer their inventory to multiple ad exchanges at once, which allows them to earn higher revenue. However, this process often involves collecting and distributing personal user data, such as browsing history, location, and device information. So, it requires new techniques to maintain the effectiveness of monetization strategies without compromising user privacy.

The most significant header bidding facts of 2024

- 70% of publishing websites and 16% of the top 100,000 websites in the US used header bidding to boost eCPMs, increase fill rates, and maximize revenues.

- Share of mobile in header bidding advertising spending worldwide grew by 20% from 2019 to 2020 and is still growing.

- Transparency and revenue growth remain crucial for publishers. At this point, header bidding is doing great work for media companies. The 1+1 media’s header bidding integration caused 25% ad sales income growth.

- Header bidding is the most effective solution a publisher can use to monetize their websites in 2024. Various header bidding solutions have appeared in reaction to market needs.

- For publishers, header bidding technology facilitates to optimize yield, cut down on passbacks, and increase the transparency of inventory value.

Header Bidding changed the programmatic advertising industry, bringing more transparency and forecasting for better business strategy for publishers and their partners. This technology became more affordable as many supply-side platforms provided free access and connection. This method of ad buying infused many benefits into the media supply chain, and it will last and develop in 2025.

[ad_2]

Source link